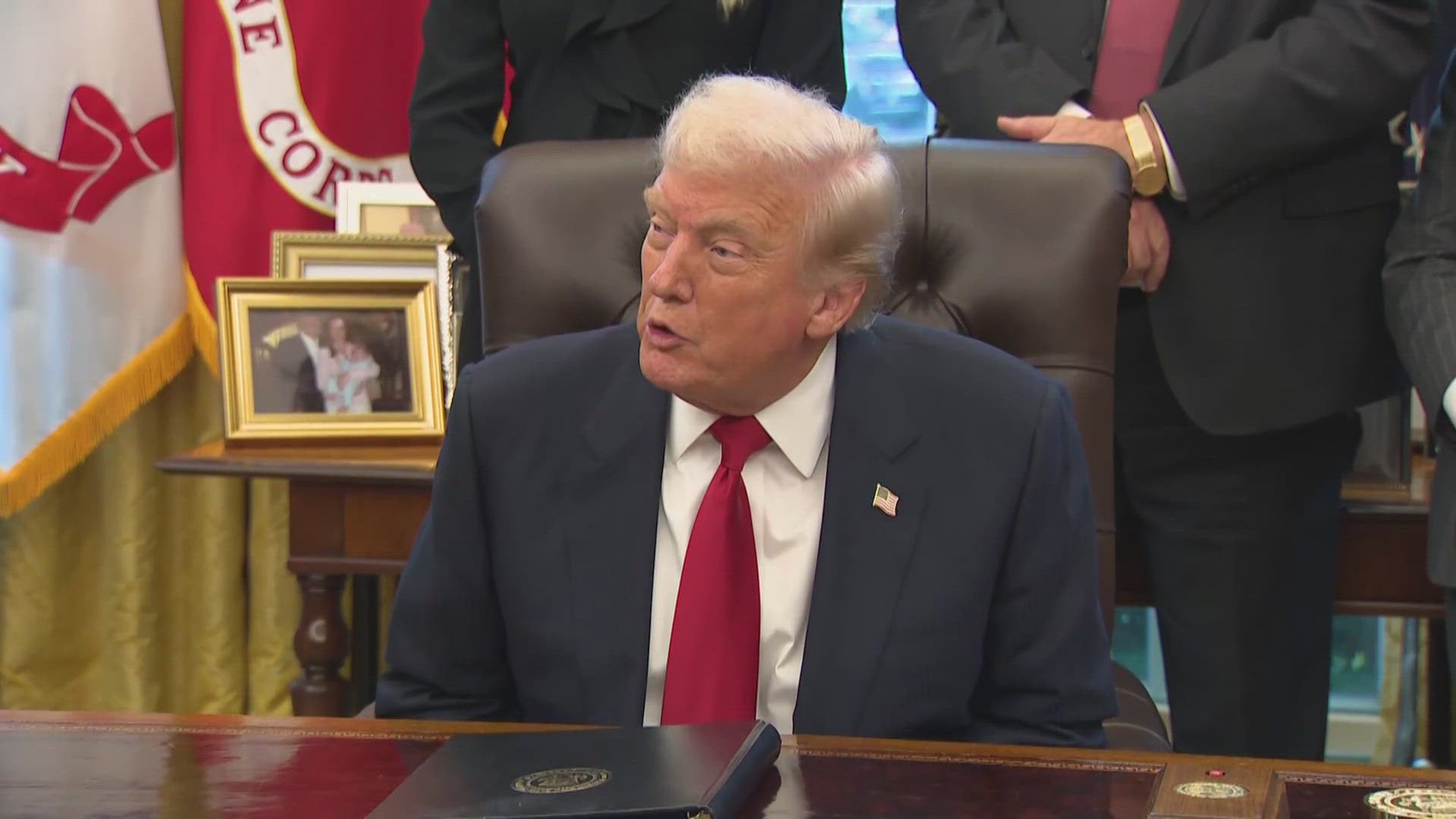

Trump’s Tariffs vs. Europe’s Trade Bazooka: Greenland Standoff Heats Up

A new round of tariff threats has intensified economic uncertainty across the Atlantic, raising concerns that trade disputes could spill over into broader financial and political consequences. What began as a diplomatic standoff now risks becoming a structural challenge for two of the world’s most interconnected economies.The latest warnings issued by Donald Trump have reignited fears of a trade confrontation between the United States and several European nations. By signaling the possible imposition of new tariffs on imports from a group of Northern and Western European countries, the administration has placed fresh pressure on supply chains, corporate planning and diplomatic…

:format(jpg)/f.elconfidencial.com%2Foriginal%2F085%2Fed4%2F8c3%2F085ed48c34b5a513dd9e9e20779e041c.jpg)